I tested every health insurance option for freelancers, and here’s what actually works…

As someone who works with self-employed professionals every day at ABC Insurance Group, I’ve heard countless stories from gig workers just like you—the graphic designer who put off doctor visits to save money, the rideshare driver who lived in constant fear of an accident, the consultant who paid nearly double her mortgage for basic health coverage.

The freedom of self-employment comes with incredible benefits—setting your own schedule, choosing your clients, building something that’s truly yours. But that independence often comes with a significant challenge: finding affordable health insurance without an employer’s support.

It’s a challenge I’m passionate about solving.

The Freelancer’s Health Insurance Dilemma

When you work for yourself, traditional health insurance options often feel like they weren’t designed with you in mind. And truthfully, they weren’t.

Most health insurance systems were built around the employer-employee relationship. They assume steady paychecks, predictable annual income, and the ability to wait for specific enrollment periods.

But your reality as a gig worker is different:

- Your income fluctuates month to month

- You may have busy seasons and slower periods

- You need the flexibility to adjust coverage as your business evolves

- You can’t always predict when you’ll need to enroll or make changes

This disconnect creates a situation where many self-employed professionals end up making a dangerous gamble—going without coverage entirely.

The Hidden Costs of Being Uninsured

Working without a safety net might seem like a necessary risk when you’re building your independent career. But the potential costs extend far beyond just medical bills.

Without proper health coverage:

- A single emergency room visit could wipe out months of savings

- Chronic conditions may go untreated, leading to more serious health issues

- Preventive care gets postponed, missing opportunities to catch problems early

- The constant stress of uncertainty affects your mental health and productivity

- Your business itself becomes vulnerable to disruption if you face health challenges

As someone who’s helped thousands of freelancers find better solutions, I’ve seen how proper coverage provides something beyond just medical protection—it gives you the confidence to focus on growing your business without the shadow of healthcare uncertainty.

Three Critical Mistakes Self-Employed Professionals Make

At ABC Insurance Group, I’ve seen common patterns in how freelancers approach health insurance. Here are the top three mistakes:

Mistake #1: Assuming All Health Insurance Is Unaffordable

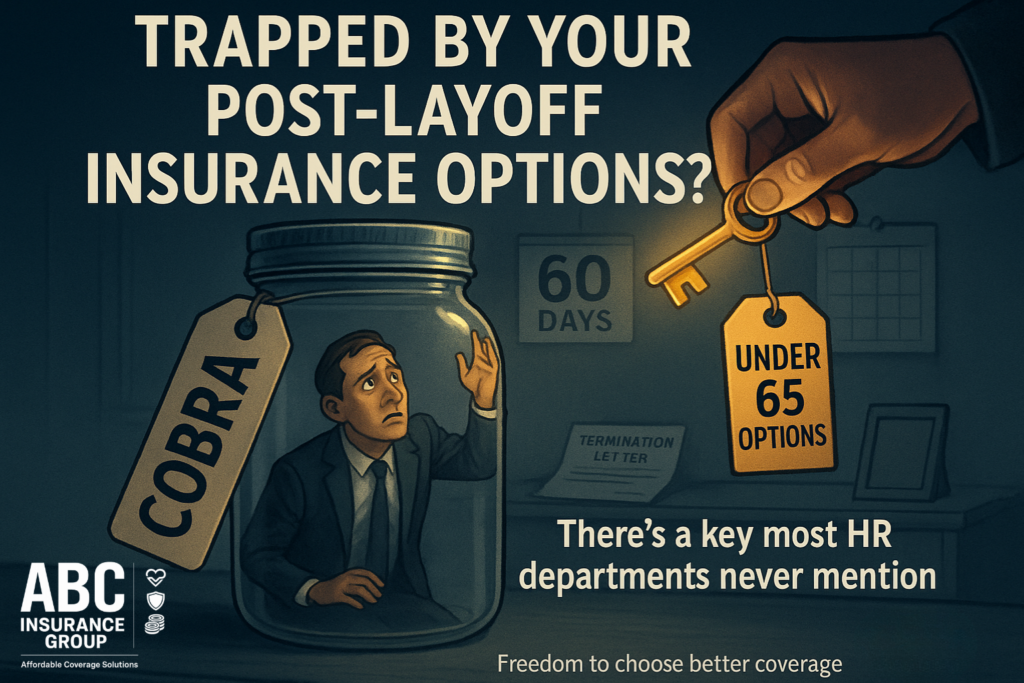

Many gig workers look at marketplace premiums and immediately conclude that quality health insurance is out of reach. They don’t realize that private Under 65 health insurance options often provide more flexible, tailored coverage at significantly lower rates.

Mistake #2: Taking an All-or-Nothing Approach

Too many freelancers think their only options are either comprehensive (and expensive) coverage or nothing at all. In reality, there’s a spectrum of protection available—from private plans to health sharing options to supplemental coverage that can be mixed and matched to your specific needs.

Mistake #3: Waiting Until It’s Too Late

Perhaps the most dangerous mistake is postponing the decision until a health crisis forces your hand. By then, your options become limited, more expensive, and less likely to provide the coverage you actually need.

The Smart Freelancer’s Approach to Health Coverage

After helping countless independent professionals secure appropriate protection, I’ve developed a framework that works particularly well for the self-employed:

1. Prioritize Flexibility

Look for plans that support your independent lifestyle:

- Year-round enrollment opportunities

- The ability to adjust coverage as your business evolves

- Options that accommodate fluctuating income

2. Focus on What Actually Matters

The smartest gig workers prioritize:

- Access to trusted healthcare providers

- Coverage tailored to specific health concerns

- Plans aligned with how they actually use healthcare services

3. Balance Protection and Affordability

It’s not about the cheapest or most comprehensive plan—it’s about balance:

- Catastrophic expense protection to safeguard your business

- Manageable monthly costs for your income level

- Transparent pricing without hidden fees or surprise bills

Taking the Next Step: Your Personalized Path Forward

As someone who works with self-employed professionals every day at ABC Insurance Group, I’ve seen how transformative the right health coverage can be. Not just for physical wellbeing, but for the confidence and stability it brings.

The path forward starts with understanding your options—not through impersonal forms or one-size-fits-all solutions, but through conversations with specialists who understand the freelance lifestyle.

Our licensed agents at ABC Insurance Group focus exclusively on helping people like you. We understand self-employment because we work with independent professionals every single day.

Your freedom shouldn’t come with a health insurance penalty. You deserve a plan that supports your path—without creating roadblocks.

Whether you’re a writer, developer, driver, creator, consultant, or any other type of independent professional, there’s a health insurance solution that fits your specific situation.

Don’t Let Another Day Pass Without Protection

Your business deserves your full focus—not worries about health coverage.

Call (833) 810-5029 now and discover what our licensed agents can do for you in just one 10-minute conversation. Your future self will thank you.

Thanks for reading. Your health and independence matter to us.