The Insider's Guide to Affordable Protection

1. The Health Insurance Crisis No One’s Talking About

In today’s America, finding affordable health insurance under age 65 has become increasingly challenging. Premiums keep climbing while coverage benefits shrink.

Whether you’re self-employed, recently unemployed, or planning for early retirement, this perfect storm of rising costs and confusing options can leave you feeling overwhelmed and unprotected.

Did you know:

- Average family premiums have risen nearly 47% over the past decade, far outpacing wage growth.

- Deductibles for many Americans have more than doubled.

- Hidden limitations and unnecessary plan features often inflate monthly costs without adding value.

Many people unknowingly overpay for benefits they don’t need. Most marketplaces have become a labyrinth of jargon and hidden costs—making it nearly impossible to choose the right plan on your own.

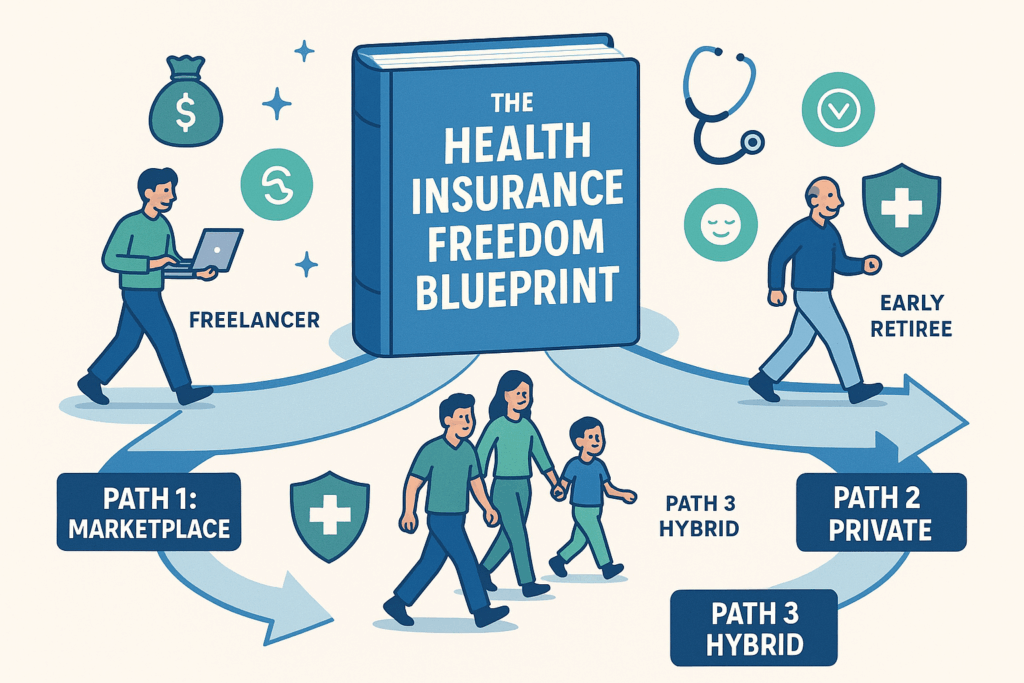

2. Introducing the 3-Path Method to Affordable Coverage

Our “3-Path Method” helps you identify which of the three coverage routes best fits your needs:

1. Optimized Marketplace Plans

- Ideal if you qualify for ACA subsidies or require comprehensive coverage.

- Seasoned licensed agents can guide you through the ACA marketplace to secure the best possible subsidized plan.

2. Private Insurance Alternatives

- For those who prefer plans outside the marketplace, with flexible networks and customizable benefits.

- Seasoned licensed agents can match you to vetted private carriers that may offer lower premiums or broader networks.

3. Hybrid Solutions

- Combine marketplace and private options to balance cost and coverage.

- These are tailored for unique cases where neither a standalone solution is optimal.

By choosing the right path, you gain access to plans that balance affordability with the coverage you need.

3. Eliminating Unnecessary Coverage Features

Overpaying often comes from paying for benefits you’ll never use. This guide teaches you and outlines how to:

- Identify plan features that add real value versus those that unnecessarily raise premiums.

- Spot and remove irrelevant add-ons (e.g., maternity coverage for retirees, specialty treatments you’re unlikely to need).

- Streamline your coverage so you pay only for what matters to you.

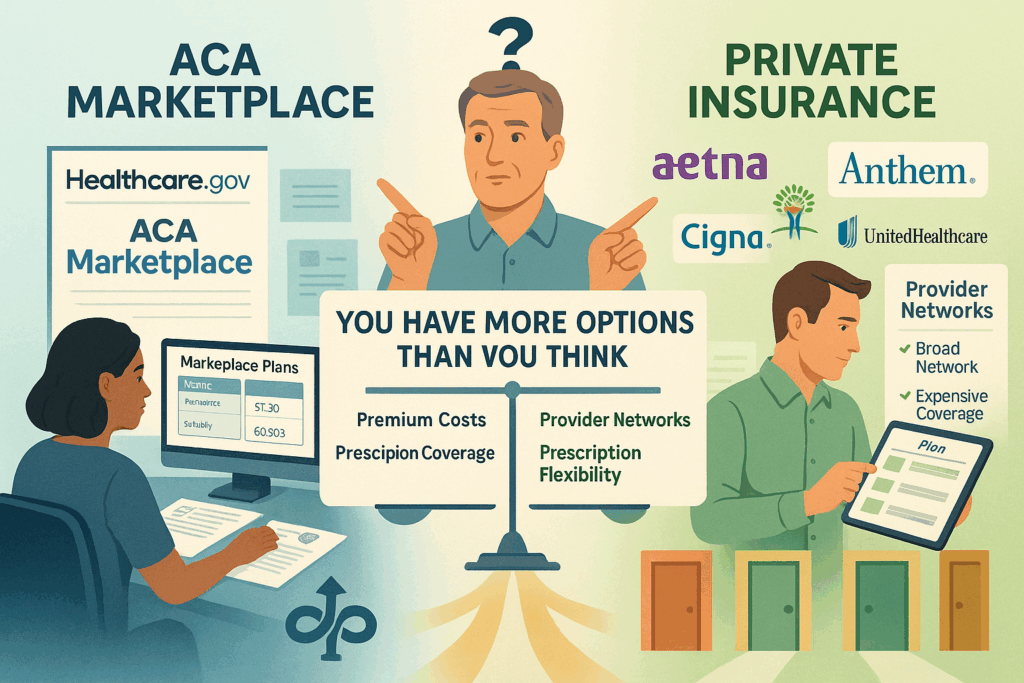

4. ACA Marketplace vs. Private Insurance

Many assume the ACA marketplace is their only option—but private alternatives can offer savings and flexibility. Our custom plans offer side-by-side comparisons that cover:

- Premium structures and subsidy eligibility

- Provider network breadth and out-of-network costs

- Prescription drug coverage tiers

- Enrollment windows and special-enrollment triggers

You’ll learn when marketplace plans make sense—and when private options may be a better fit.

5. Debunking Common Health Insurance Misconceptions

Let’s now clear up myths that can cost you money:

- All plans cover the same services. (False—benefits vary widely.)

- Higher premiums always mean better coverage. (Not necessarily.)

- You can only enroll during Open Enrollment. (Special circumstances apply.)

- Pre-existing conditions disqualify you from affordable plans. (Many plans now cover pre-existing conditions.)

- Young, healthy people don’t need insurance. (Unexpected medical events happen to everyone.)

6. Keeping Your Preferred Doctors While Reducing Costs

If you’re worried about losing your doctor? Ask a licensed agent how you can:

- Research and confirm provider networks before enrolling

- Explore direct primary care or multi-tiered plans

- Talk to your healthcare providers about network changes

- Maintain continuity of care while lowering premiums

7. Evaluating Plans: A Step-by-Step Approach

Turn confusion into clarity with our systematic evaluation:

- List your typical healthcare needs (visits, prescriptions, specialists).

- Compare deductibles, copays, coinsurance, and out-of-pocket limits.

- Rank plans by total annual cost based on your usage.

- Factor in network access and benefit exclusions.

- Choose the plan that offers the best balance of cost and coverage.

Can you see how this systematic approach turns confusion into clarity? These are some of the questions a licensed agent will answer during your custom plan review.

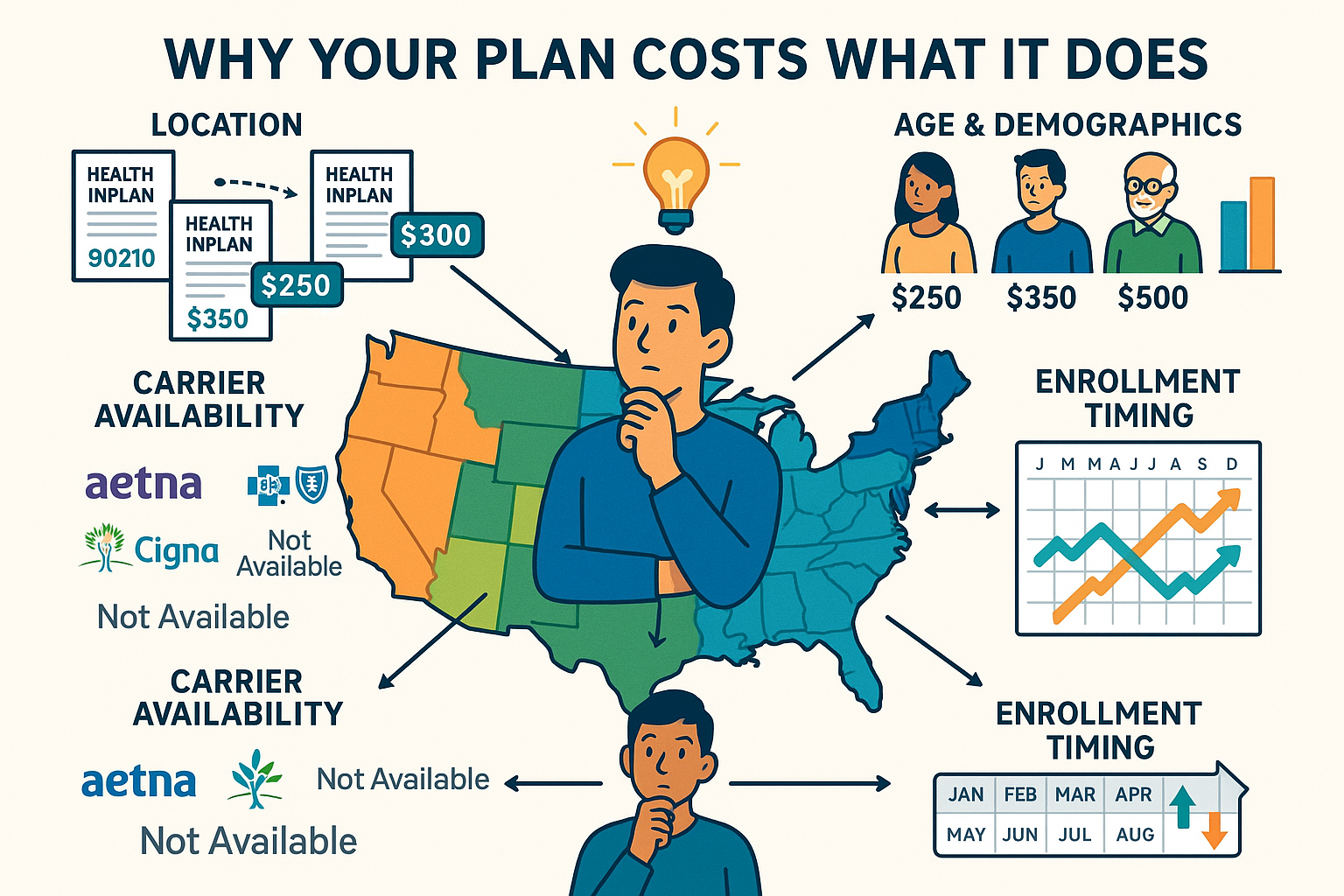

8. Understanding Plan Variability

Next, is understanding that Health plans can vary dramatically by:

- Location (the same plan can cost differently by ZIP code)

- Age and demographics (premiums adjust based on risk factors)

- Carrier availability (not all plans are offered in every area)

- Enrollment timing (pricing can fluctuate throughout the year)

Knowing these factors helps set realistic expectations and avoid potential frustration.

9. Using Our Savings Calculator Tool Effectively

Our no-obligation health insurance savings calculator tool makes planning things easy:

- Enter your details accurately to see tailored results

- Use filters to prioritize your top benefits (e.g., employment status, current insurance type)

- Receive a free custom health insurance plan personalized to your specific needs.

- Remember: we’re an independent resource connecting you with licensed insurers—no obligation or pressure to buy.

10. The Importance of Verification

Always confirm final plan details with a licensed insurer:

- Ask about network changes and provider directory accuracy

- Request a sample policy or benefits summary

- Verify any subsidies or rate guarantees before enrolling

- Keep documentation of all communications for your records

By following the strategies in The Health Insurance Freedom Blueprint, you’ll gain confidence, clarity, and control—empowering you to find affordable coverage that truly meets your needs. Request your free custom health insurance plan today and take the first step toward better protection at a price you can afford.