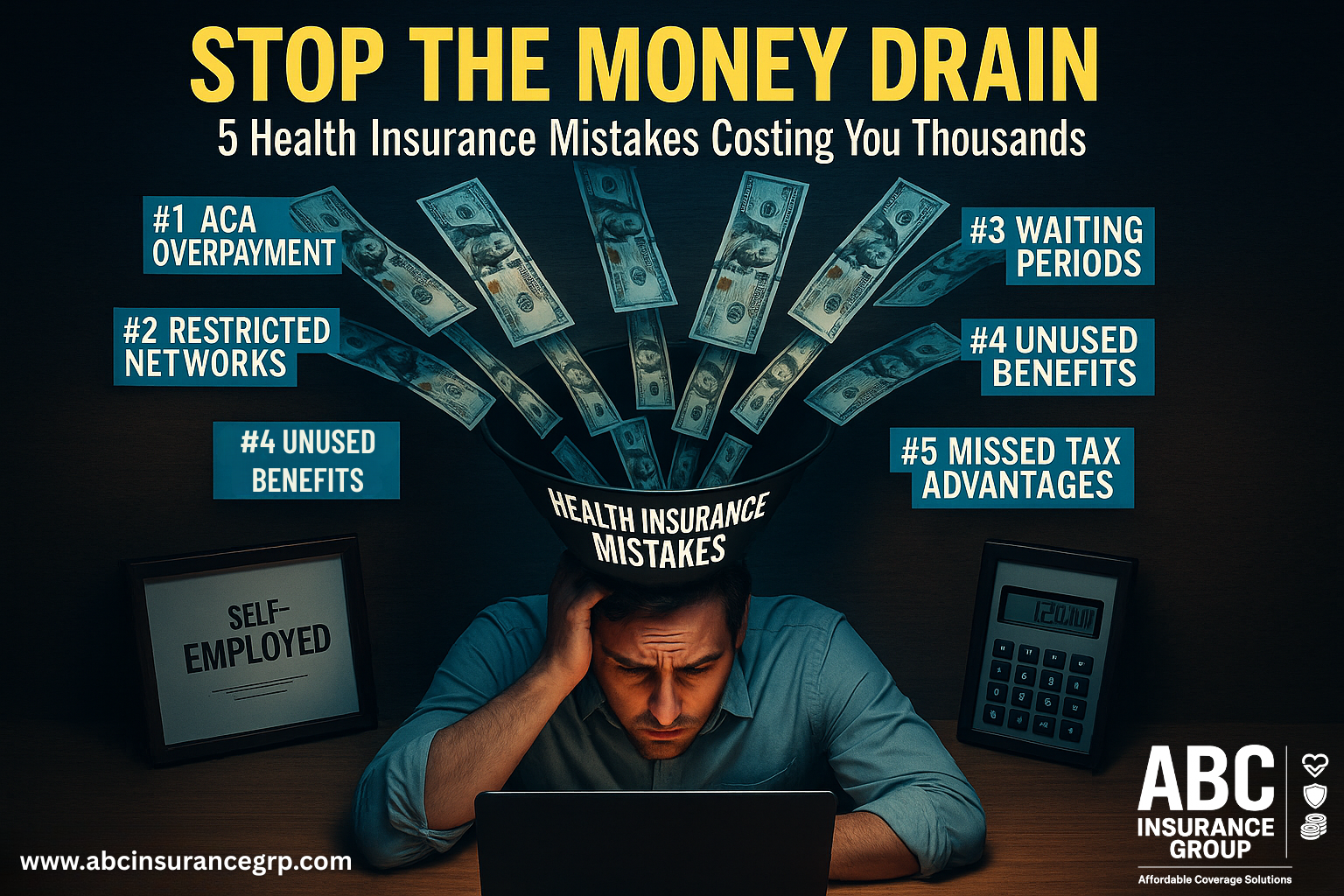

The Costly Mistake I Made My First Year in Business (And How You Can Avoid It)

When I left my corporate job to start my own business, I thought I had everything figured out. My business plan was solid, my savings were adequate, and my client pipeline was promising.

But there was one critical area I completely overlooked: health insurance. That oversight cost me tens of thousands in unnecessary premiums and out-of-pocket expenses — in just one year.

At ABC Insurance Group, we see self-employed professionals like this make the same costly health insurance mistakes every day. The good news? These mistakes are entirely avoidable with the right information.

Mistake #1: Automatically Enrolling in the Most Expensive ACA Marketplace Plan

Many self-employed individuals assume that comprehensive ACA marketplace plans are their only option. While these plans provide essential benefits, they often come with premium price tags that can drain your business resources.

The Reality: Private U65 health insurance plans can offer savings of 30–60% compared to ACA marketplace plans — while maintaining quality coverage.

The Solution: Work with a licensed agent who can compare marketplace and private options side-by-side. At ABC Insurance Group, we analyze plans from multiple carriers to find the perfect balance of coverage and affordability.

Mistake #2: Overlooking Flexible Network Options

When you’re self-employed, your schedule and location might change frequently. Many freelancers make the mistake of choosing plans with restrictive networks that limit their provider choices.

The Reality: Some U65 health insurance plans offer nationwide provider networks, allowing you to maintain coverage whether you’re working from home, traveling for client meetings, or relocating temporarily.

The Solution: Prioritize plans with flexible networks that accommodate your mobile lifestyle. Our network of agents at ABC Insurance Group verify that your preferred doctors are in-network before you commit to any plan.

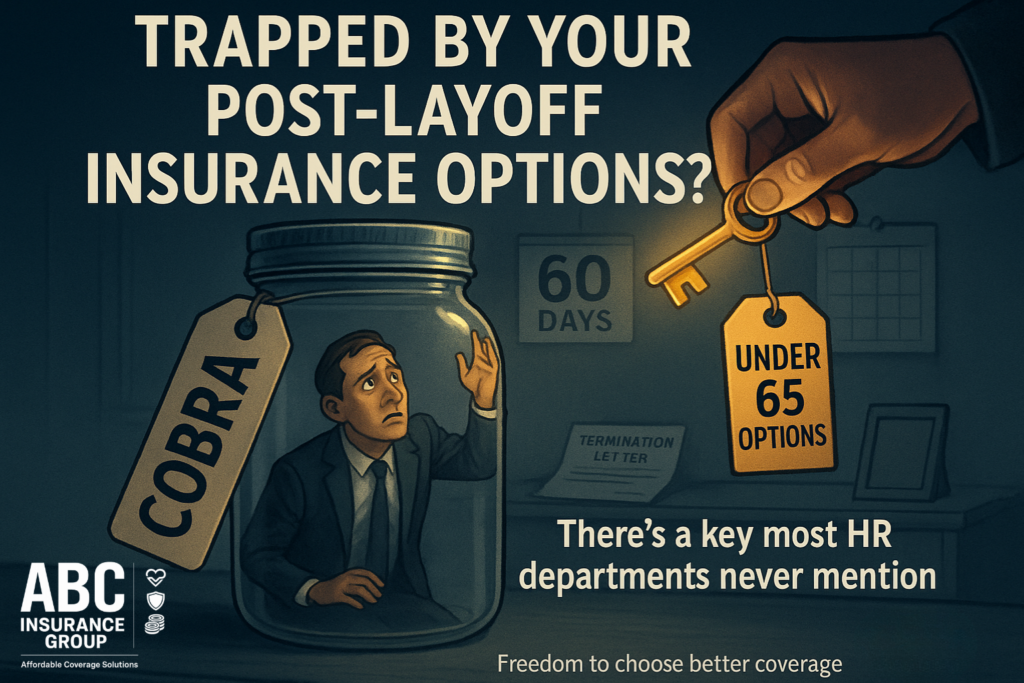

Mistake #3: Waiting for Open Enrollment Periods

One of the biggest misconceptions among self-employed professionals is that they can only enroll in health insurance during the annual open enrollment period (typically November–December).

The Reality: Many U65 health insurance options are available year-round, meaning you don’t have to wait months for coverage if you’ve recently left your job or lost employer-sponsored insurance.

The Solution: Explore year-round enrollment options that can provide immediate coverage. Our network of licensed agents can help you understand which plans are available now, regardless of the time of year.

Mistake #4: Paying for Benefits You’ll Never Use

Standard health insurance plans often include coverage for services you don’t need, resulting in unnecessarily high premiums.

The Reality: Customizable U65 health plans allow you to select coverage that aligns with your specific health needs and budget.

The Solution: Work with an insurance professional who takes the time to understand your unique health requirements and recommends tailored coverage options.

Mistake #5: Ignoring Tax Advantages and Deductions

Many self-employed professionals leave money on the table by not leveraging available tax benefits related to health insurance.

The Reality: Self-employed individuals can often deduct health insurance premiums as a business expense, potentially saving thousands in taxes annually. Additionally, options like Health Savings Accounts (HSAs) offer triple tax advantages for those with qualifying high-deductible health plans.

The Solution: Consult with an insurance professional and a tax advisor to maximize your potential tax benefits. Our network of agents at ABC Insurance Group can help identify plans that offer optimal tax advantages for self-employed individuals.

Real Savings for Real Entrepreneurs

At ABC Insurance Group, we specialize in helping self-employed professionals find affordable health coverage options that traditional marketplace plans don’t offer. Most people typically save 30–60% on their health insurance premiums while maintaining quality coverage.

Don’t Navigate Health Insurance Alone

Finding the right health insurance as a self-employed professional doesn’t have to be complicated — or expensive.

At ABC Insurance Group, our licensed agents will help you:

✅ Compare multiple carriers to find your best rates

✅ Verify your preferred doctors are covered

✅ Understand all premiums and deductibles with transparent cost breakdowns

✅ Identify potential tax advantages

✅ Secure coverage that fits both your health needs and your budget

Don’t make the same mistake many others do unknowingly.

📞 Click-To-Call ABC Insurance Group at (833) 810-5029 today Speak to a licensed agent, or

🌐 Click Here to request a quote and explore your options.

Your business deserves to thrive — without the burden of excessive health insurance costs.