The Hidden Truth About Health Insurance That's Costing You Thousands

Did you know that medical debt is the leading cause of bankruptcy in America? What’s even more shocking is that many Americans with health insurance are still paying double what they should be.

As someone who’s helped thousands find affordable coverage at ABC Insurance Group, I’ve seen firsthand how people unknowingly throw away hundreds—sometimes thousands—of dollars every month on overpriced health insurance.

Just last month, Angela and Stephen from Florida came to us after losing their employer coverage. They were quoted $1,800 monthly for an ACA marketplace plan. After reviewing their situation, we found them comparable coverage for just $900 per month. Their reaction? “Why didn’t anyone tell us these options existed?”

Let’s pull back the curtain on why you might be drastically overpaying for health insurance.

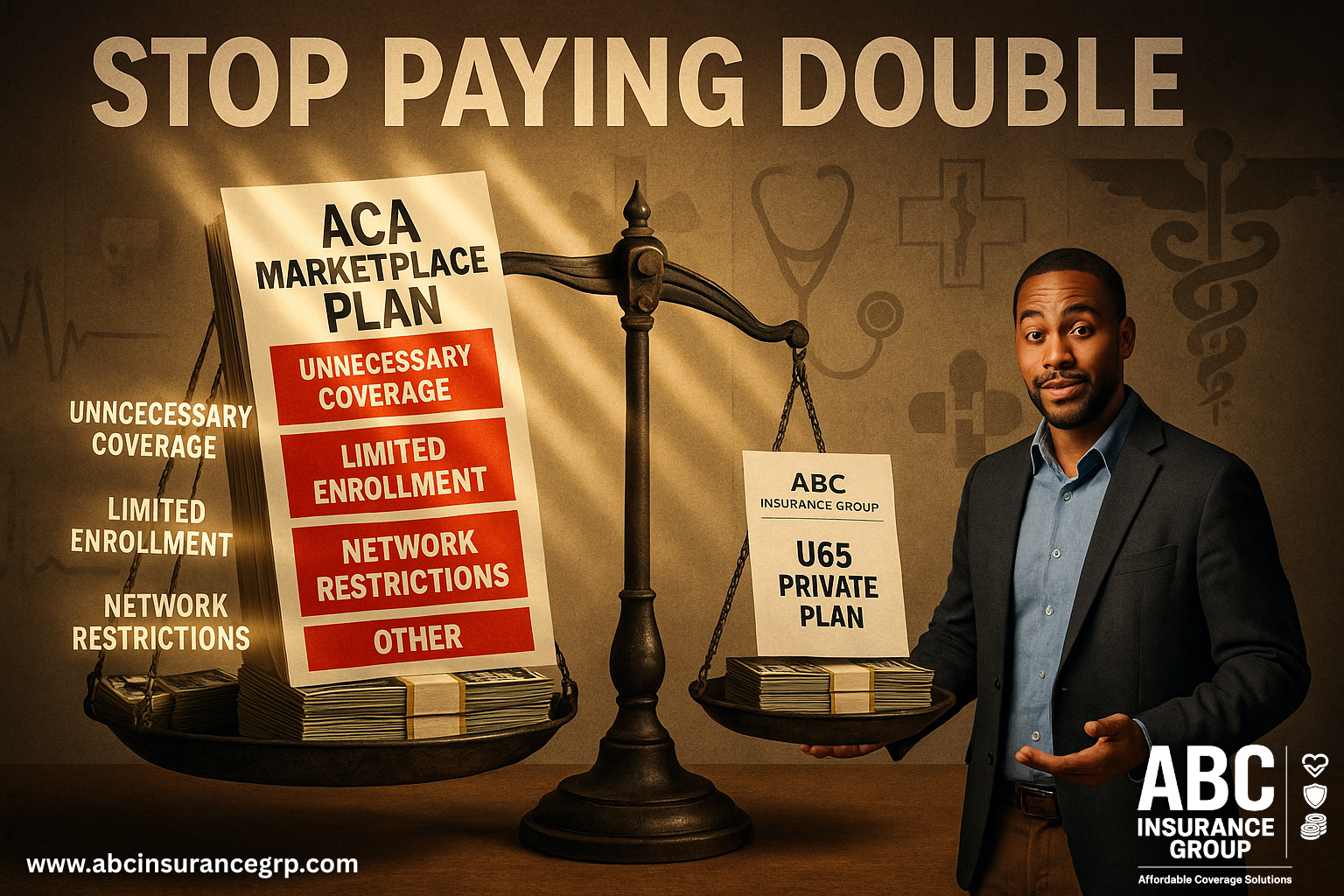

1. You’re Paying for Benefits You’ll Never Use

The Affordable Care Act requires marketplace plans to cover ten essential health benefits—regardless of whether you need them. If you’re a 55-year-old man, you’re still paying for maternity care. If you’re past childbearing age, you’re subsidizing pediatric services.

Private U65 health insurance plans can be customized to your specific needs. Our clients typically save 30–60% by eliminating unnecessary benefits while maintaining quality coverage for what actually matters to them.

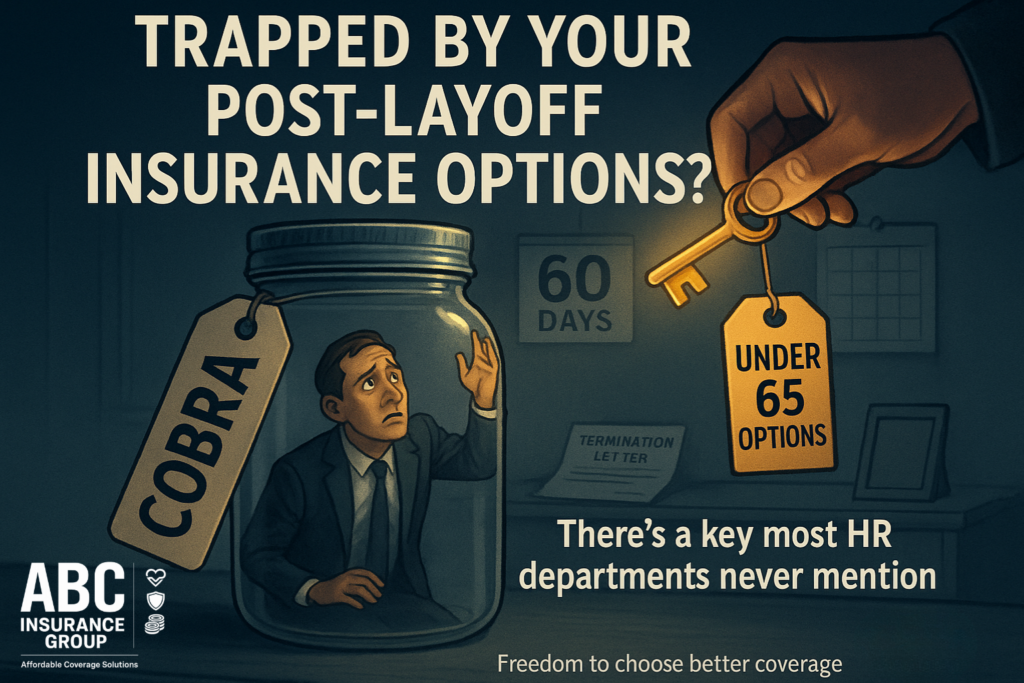

2. Limited Enrollment Periods Keep You Trapped

ACA marketplace enrollment is restricted to a brief annual window (typically November through Mid-December). Miss this window, and you’re locked out unless you experience a qualifying life event like job loss or marriage.

This artificial restriction creates urgency and limits your ability to shop around. What many don’t realize is that private U65 plans are available year-round, offering flexibility to find coverage when you need it — not when the government says you can have it.

3. The “Subsidy Cliff” Is Pushing Middle-Income Americans Over the Edge

If your income exceeds 400% of the federal poverty level, you don’t qualify for premium tax credits.

This creates a “subsidy cliff” where middle-income Americans face the full brunt of premium costs.

For example, a couple earning $70,000 might receive substantial subsidies, while a couple earning $75,000 could pay full price—often thousands more annually for identical coverage.

At ABC Insurance Group, we’ve helped countless clients in this situation find affordable private plans that don’t depend on government subsidies.

4. Narrow Networks Force You to Abandon Trusted Doctors

Many marketplace plans feature restricted provider networks to control costs. This often means sacrificing relationships with trusted doctors or traveling farther for care.

Our private U65 plans frequently offer broader networks and more flexibility. During our consultation process, we verify that your preferred doctors are covered before you commit to any plan.

5. You’re Subsidizing High-Risk Individuals in the Risk Pool

ACA plans use community rating, meaning everyone in a geographic area pays similar premiums regardless of health status.

While this helps those with pre-existing conditions, it significantly increases costs for healthier individuals.

Private U65 plans can offer lower premiums for those in good health while still providing guaranteed acceptance options for those with medical conditions.

This more balanced approach often results in substantial savings.

6. Hidden Administrative Costs Are Inflating Your Premiums

The bureaucracy behind marketplace plans adds layers of administrative costs that get passed directly to you. These include exchange fees, compliance costs, and marketing expenses.

Many private plans operate with streamlined efficiency, resulting in lower overhead — and consequently, lower premiums.

One of our carrier partners recently shared that their administrative costs are 40% lower than comparable marketplace plans.

7. You Haven’t Explored All Your Options

Perhaps the most shocking reason you’re overpaying is simply lack of awareness.

Many Americans don’t realize alternatives exist outside the ACA marketplace.

At ABC Insurance Group, we specialize in helping people under 65 find affordable health coverage options that traditional marketplace plans don’t offer.

Our licensed agents compare multiple carriers to find the best fit for your specific situation.

How to Stop Overpaying Today

Finding the right health insurance shouldn’t require a degree in healthcare economics.

That’s why our approach at ABC Insurance Group is refreshingly straightforward:

- We listen to your specific needs and budget constraints.

- We compare options across multiple carriers.

- We verify your doctors are in-network.

- We provide transparent cost breakdowns.

- We handle the enrollment process from start to finish.

Whether you’re self-employed, an early retiree, or simply looking for more affordable options, we can help you stop overpaying for health insurance.

Don’t wait for the next premium increase to explore your options. Most people we’ve helped save an average of 30–60% on their monthly premiums while maintaining quality coverage.

📞 Speak to a licensed agent today at (833) 810-5029 or

🌐 Click here to get your free, no-obligation quote.

Remember: You don’t have to choose between affordable premiums and quality coverage.

With the right guidance, you can have both.